比起创造大量就业机会,乔·拜登对高通胀负有更大责任

比起创造大量就业机会,乔·拜登对高通胀负有更大责任

Joe Biden is more responsible for high inflation than for abundant jobs

译文简介

比起创造大量就业机会,乔·拜登对高通胀负有更大责任

正文翻译

The main effect of the president’s economic policies has been to boost prices

总统的经济政策的主要影响是推高物价。

The way Joe Biden tells it, the only part of his economic record that really matters is jobs. America’s roaring labour market beat expectations again in April. The unemployment rate is lower than in any year since 1969. The share of 15- to 64-year-olds in employment has surpassed its pre-pandemic peak, which was itself the highest seen since 2007. Mr Biden likes to tell people that his presidency, which began in the midst of a rapid recovery from covid lockdowns, has coincided with more monthly job creation, on average, than any other in history. Provided America avoids a debt-ceiling crisis, and the associated halt to federal spending and probable lay-offs, the booming labour market looks like a ticket to re-election in 2024.

乔·拜登所说的,他经济政策记录中唯一重要的部分就是就业。美国的劳动力市场在4月再次超越预期,失业率低于1969年以来的任何一年。15岁至64岁的就业人口比疫情前的峰值更高,而该峰值本身已是自2007年以来最高。拜登喜欢告诉人们,他的总统任期与快速从疫情封锁中恢复的时期重合,平均每月创造的就业机会比历史上任何其他时期都要多。只要美国避免债务上限危机以及随之而来的联邦支出停滞和可能的裁员,繁荣的劳动力市场看起来像是2024年重新当选的保证。

乔·拜登所说的,他经济政策记录中唯一重要的部分就是就业。美国的劳动力市场在4月再次超越预期,失业率低于1969年以来的任何一年。15岁至64岁的就业人口比疫情前的峰值更高,而该峰值本身已是自2007年以来最高。拜登喜欢告诉人们,他的总统任期与快速从疫情封锁中恢复的时期重合,平均每月创造的就业机会比历史上任何其他时期都要多。只要美国避免债务上限危机以及随之而来的联邦支出停滞和可能的裁员,繁荣的劳动力市场看起来像是2024年重新当选的保证。

Unfortunately for Mr Biden, however, another part of his record tells a less flattering story. High inflation continues to imperil the economy and vex voters. And placing his record in a global context reveals that he is more responsible for surging prices than he is for abundant jobs.

然而,对于拜登来说,他记录中的另一部分讲述了一个不太讨人喜欢的故事。高通胀继续威胁经济并困扰选民。将他的记录放在全球背景下,可以发现他对于物价飙升的责任比他对于丰富就业的责任更大。

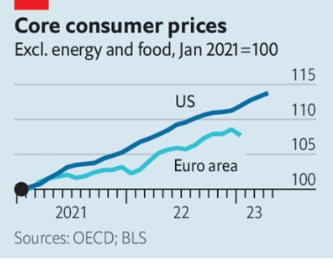

核心消费者物价指数,不包括能源和食品,2021年1月=100。

Euro area(欧元区)US(美国)

然而,对于拜登来说,他记录中的另一部分讲述了一个不太讨人喜欢的故事。高通胀继续威胁经济并困扰选民。将他的记录放在全球背景下,可以发现他对于物价飙升的责任比他对于丰富就业的责任更大。

核心消费者物价指数,不包括能源和食品,2021年1月=100。

Euro area(欧元区)US(美国)

(核心消费者物价指数(Core Consumer Price Index,简称Core CPI)是指在消费者物价指数(CPI)中排除食品和能源等波动性较大的物价成分后得到的指数。它是衡量通货膨胀的重要指标之一。

Core CPI通常被认为比CPI更能反映经济的真实情况,因为它能够排除一些短期因素的影响,如天气、自然灾害等。此外,Core CPI还可以帮助央行更准确地制定货币政策。)

Mr Biden is right that America’s post-covid jobs recovery has been exceptional by historical standards. After the global financial crisis it took 13 years, by some measures, for the labour market to regain its health. This time it has taken little more than three years. The White House attributes surging employment to the $1.9trn “rescue plan” Mr Biden unleashed shortly after taking office in 2021. It contributed nearly a third of America’s total pandemic-related fiscal stimulus, which was worth an astonishing 26% of gdp, more than twice the average in the rich world.

拜登是正确的,美国的疫后就业复苏在历史上是非常出色的。在全球金融危机之后,劳动力市场恢复健康需要13年,而这一次只需要了三年多一点。白宫将激增的就业归因于拜登在2021年就任后推出的1.9万亿美元的“救援计划”。它贡献了美国总共的疫情相关财政刺激的近三分之一,价值惊人的gdp的26%,是富裕国家平均水平的两倍以上。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

拜登是正确的,美国的疫后就业复苏在历史上是非常出色的。在全球金融危机之后,劳动力市场恢复健康需要13年,而这一次只需要了三年多一点。白宫将激增的就业归因于拜登在2021年就任后推出的1.9万亿美元的“救援计划”。它贡献了美国总共的疫情相关财政刺激的近三分之一,价值惊人的gdp的26%,是富裕国家平均水平的两倍以上。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

If the Biden stimulus had been responsible for the jobs boom, though, you would expect America’s labour market to be stronger than those of its peers. But in Canada, France, Germany and Italy working-age employment rates surpassed pre-pandemic highs by the end of 2021; Japan followed in 2022. Among the g7 group of economies America has beaten to a full recovery only Brexit-blighted Britain, where the employment rate is still lower than it was at the end of 2019.

That employment bounced back in most places suggests that America’s jobs recovery had more to do with the unusual nature of the pandemic recession, brought about by lockdowns and social distancing, than with Mr Biden’s gargantuan stimulus. The extra public spending surely boosted demand for workers, but what followed was a historic surge in job vacancies and worker shortages as the economy overheated. Actual employment would almost certainly have shot up anyway. By the time Mr Biden came to office the jobs recovery was already two-thirds complete, having defied economists’ gloomy predictions.

然而,如果拜登的刺激计划负责就业繁荣,你会预期美国的劳动力市场比同行更强大。但在加拿大、法国、德国和意大利,工作年龄人口的就业率已在2021年底超过了疫情前的高峰;日本在2022年跟随。在G7经济体中,只有受到脱欧影响的英国还没有完全恢复,就业率仍低于2019年底。这表明,大多数地方就业的反弹更多地与疫情大流行引起的封锁和社交疏远的不寻常性有关,而不是与拜登的巨大刺激有关。额外的公共支出无疑增加了对工人的需求,但随之而来的是历史性的就业机会激增和工人短缺,因为经济过热。实际就业几乎肯定会大幅增加。在拜登上任时,就业复苏已经完成了三分之二,违抗了经济学家的悲观预测。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

That employment bounced back in most places suggests that America’s jobs recovery had more to do with the unusual nature of the pandemic recession, brought about by lockdowns and social distancing, than with Mr Biden’s gargantuan stimulus. The extra public spending surely boosted demand for workers, but what followed was a historic surge in job vacancies and worker shortages as the economy overheated. Actual employment would almost certainly have shot up anyway. By the time Mr Biden came to office the jobs recovery was already two-thirds complete, having defied economists’ gloomy predictions.

然而,如果拜登的刺激计划负责就业繁荣,你会预期美国的劳动力市场比同行更强大。但在加拿大、法国、德国和意大利,工作年龄人口的就业率已在2021年底超过了疫情前的高峰;日本在2022年跟随。在G7经济体中,只有受到脱欧影响的英国还没有完全恢复,就业率仍低于2019年底。这表明,大多数地方就业的反弹更多地与疫情大流行引起的封锁和社交疏远的不寻常性有关,而不是与拜登的巨大刺激有关。额外的公共支出无疑增加了对工人的需求,但随之而来的是历史性的就业机会激增和工人短缺,因为经济过热。实际就业几乎肯定会大幅增加。在拜登上任时,就业复苏已经完成了三分之二,违抗了经济学家的悲观预测。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

Mr Biden’s stimulus did, however, put a rocket under inflation. In April “core” consumer prices, which exclude energy and food, were 13.4% higher than when he came to office. They have risen more than in other g7 countries, and their acceleration coincided with the introduction of Mr Biden’s stimulus. Research suggests that, even by September 2022, the largesse was pushing up core inflation by about four percentage points.

然而,拜登的刺激计划确实推高了通胀。在4月,“核心”消费价格(不包括能源和食品)比他上任时高出13.4%。它们上涨的幅度比其他g7国家更高,而且它们的加速与拜登的刺激计划的推出相吻合。研究表明,即使到2022年9月,这种慷慨会将核心通胀率推高约4个百分点。

然而,拜登的刺激计划确实推高了通胀。在4月,“核心”消费价格(不包括能源和食品)比他上任时高出13.4%。它们上涨的幅度比其他g7国家更高,而且它们的加速与拜登的刺激计划的推出相吻合。研究表明,即使到2022年9月,这种慷慨会将核心通胀率推高约4个百分点。

The White House is not solely responsible for inflation: the Federal Reserve failed to raise interest rates in time to offset the fiscal stimulus, and the energy crisis that followed Russia’s invasion of Ukraine made a bad problem worse. But it was Mr Biden who lit the inflationary touch-paper—and whose signature policies are probably still boosting prices. It is now clear that the Inflation Reduction Act, which was supposed to cool the economy by shrinking deficits, will in fact widen them, owing to the higher-than-forecast take-up of its clean-energy tax credits.

白宫并不是通货膨胀的唯一责任方:联邦储备未能及时提高利率以抵消财政刺激措施,随之而来的俄罗斯入侵乌克兰引发的能源危机使问题更加严重。但是拜登点燃了通货膨胀的导火索,他的标志性政策可能仍在推高物价。现在清楚的是,旨在通过缩小赤字来冷却经济的《通货膨胀降低法案》实际上会使赤字扩大,因为其清洁能源税收抵免的使用率高于预期。

白宫并不是通货膨胀的唯一责任方:联邦储备未能及时提高利率以抵消财政刺激措施,随之而来的俄罗斯入侵乌克兰引发的能源危机使问题更加严重。但是拜登点燃了通货膨胀的导火索,他的标志性政策可能仍在推高物价。现在清楚的是,旨在通过缩小赤字来冷却经济的《通货膨胀降低法案》实际上会使赤字扩大,因为其清洁能源税收抵免的使用率高于预期。

Where America’s recent record looks exceptionally good is growth. The imf forecasts that its gdp per person will this year be 4.6% larger than in 2019, easily the biggest increase among the g7 economies. Sadly for Mr Biden, though, this has little to do with him. The outperformance reflects better growth in productivity, not a faster employment rebound. America exports more energy than it imports, meaning in aggregate it benefited from surging fuel prices. And its pandemic spending from 2020 onwards focused more on supporting incomes than preserving jobs, resulting in a faster reallocation of workers around the economy than in Europe, which relied on subsidised furlough schemes. Both factors predate Mr Biden’s presidency.

美国最近的经济增长表现非常出色。国际货币基金组织预测,美国人均gdp今年将比2019年增长4.6%,是G7经济体中增长最快的。然而,对于拜登来说,这与他无关。这种超常表现反映出生产率增长更好,而不是就业反弹更快。美国出口的能源比进口的多,意味着总体上它受益于激增的燃料价格。自2020年以来,美国的疫情支出更多地关注支持收入,而不是保护就业,导致工人在经济中的再分配比欧洲更快,欧洲依赖于补贴的休假计划。这两个因素都早于拜登的总统任期。

美国最近的经济增长表现非常出色。国际货币基金组织预测,美国人均gdp今年将比2019年增长4.6%,是G7经济体中增长最快的。然而,对于拜登来说,这与他无关。这种超常表现反映出生产率增长更好,而不是就业反弹更快。美国出口的能源比进口的多,意味着总体上它受益于激增的燃料价格。自2020年以来,美国的疫情支出更多地关注支持收入,而不是保护就业,导致工人在经济中的再分配比欧洲更快,欧洲依赖于补贴的休假计划。这两个因素都早于拜登的总统任期。

Voters seem to sense that the main effect of the president’s economic policies to date has been to worsen inflation. Polls show that far more Americans think Donald Trump, Mr Biden’s predecessor and probable opponent in 2024, did a better job than Mr Biden of handling the economy, than the reverse. The longer inflation persists, the more likely it becomes that the Fed keeps rates high enough to tip America into recession—perhaps around the time of the election. Mr Biden’s largesse could go down as the mistake that let Mr Trump back into office.

选民似乎感觉到总统的经济政策到目前为止主要是恶化了通货膨胀。民意调查显示,比起相反的情况,更多的美国人认为唐纳德·特朗普,拜登的前任和可能的2024年对手,在处理经济方面做得比拜登更好。通货膨胀持续时间越长,联邦储备保持足够高的利率将使美国陷入衰退的可能性越大,可能会在选举时期左右。拜登先生的大手笔可以作为让特朗普先生重新上台的错误而被载入史册。

选民似乎感觉到总统的经济政策到目前为止主要是恶化了通货膨胀。民意调查显示,比起相反的情况,更多的美国人认为唐纳德·特朗普,拜登的前任和可能的2024年对手,在处理经济方面做得比拜登更好。通货膨胀持续时间越长,联邦储备保持足够高的利率将使美国陷入衰退的可能性越大,可能会在选举时期左右。拜登先生的大手笔可以作为让特朗普先生重新上台的错误而被载入史册。

评论翻译

很赞 ( 2 )

收藏